19+ wage calculator ky

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. In Kentucky overtime hours are any hours over 40 worked in a single week.

Salary After Tax

Simply enter their federal and state W-4 information as well as their pay rate deductions and.

. DOR will release an updated calculator by January 1 2019 for use next year. The process is simple. Web Calculations contained herein are not exact - only estimates of values.

All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net pay for both federal and Kentucky state taxes. Web Kentucky Overtime Wage Calculator. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. Figure out your filing status. Effective July 3 2022 the minimum rate is 39 and the maximum rate is 626 per week regardless of how high the wages are.

This calculator cannot be used to calculate lump sum or total weekly benefit values for claims subject to the limitation in KRS 342730 4. Web We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Web The basic benefit calculation is easy it is 11923 of your base period wages. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Kentucky State Income Tax Rates and Thresholds in 2023. Web The basic benefit calculation is easy it is 11923 of your base period wages.

Effective July 3 2022 the minimum rate is 39 and the maximum rate is 626 per week regardless of how high the wages are. Due to this change all Kentucky wage earners will be taxed at 5 with an allowance for the standard. Web Living Wage Calculator - Living Wage Calculation for Kentucky Living Wage Calculation for Kentucky The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Calculations will not reflect application of Tier-Down if in effect. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Web Kentucky tax year starts from July 01 the year before to June 30 the current year.

Details of the personal income tax rates used in the 2023 Kentucky State Calculator are published below the. However below are some factors which may affect how you would expect the calculation to work. Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493.

Web Salary Paycheck Calculator Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Select a link below to display the living wage report for that location. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate.

However below are some factors which may affect how you would expect the calculation to work. Well do the math for youall you need to do is enter the applicable information on salary federal and state W. Web Counties and Metropolitan Statistical Areas in Kentucky.

Your household income location filing status and number of personal exemptions. Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Web While ZipRecruiter is seeing salaries as high as 154182 and as low as 41457 the majority of salaries within the Calculator jobs category currently range between 51238 25th percentile to 135549 75th percentile with top earners 90th percentile making 146263 annually in Kentucky.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. The assumption is the sole provider is working full-time 2080 hours per year. Show results for Kentucky as a whole.

Your average tax rate is 1167 and your marginal tax rate is 22. Web The calculator is in spreadsheet format so employers may use it for multiple employees and calculations are based on the 2018 withholding tax formula. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

Pdf Upgrading The Fuel Properties Of Hydrochar By Co Hydrothermal Carbonisation Of Dairy Manure And Japanese Larch Larix Kaempferi Product Characterisation Thermal Behaviour Kinetics And Thermodynamic Properties

Will A Part Time Real Estate Agent Salary Be Enough For You Mckissock Learning

Calameo Seshat Sakari El Ucc 1 Financing Statement Security Agreement Seshat Sakari El Secured Party Public Notice With Affidavit Statement Of Fact Legal Notice C Copyright Notice C Power Of Attorney In

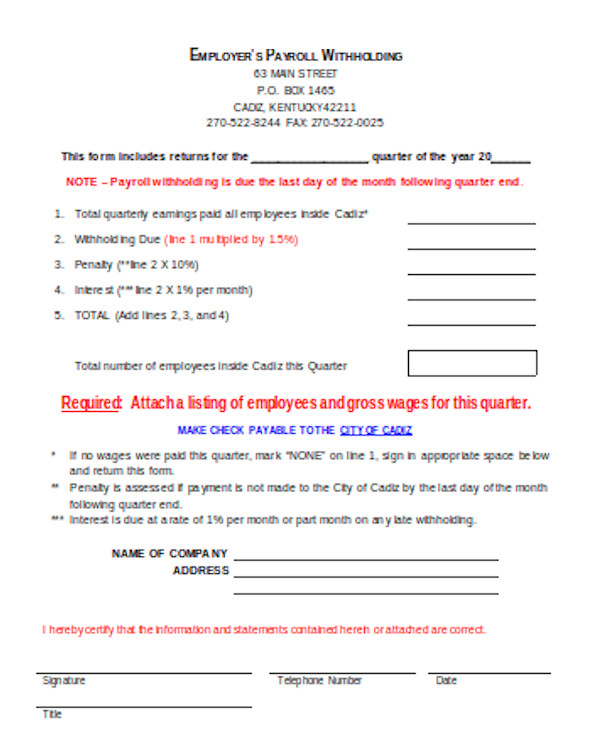

Free 8 Sample Payroll Tax Forms In Pdf Excel Ms Word

Csn 0922 By Ensembleiq Issuu

Calameo Complete Ucc 1 Package Registered Mail Re227321525us Shipped To Seshat Sakari El C O Cherie Amour Robinson From Seshat Sakari El C O Cherie Amour Robinson

The Salary Calculator Hourly Wage Tax Calculator

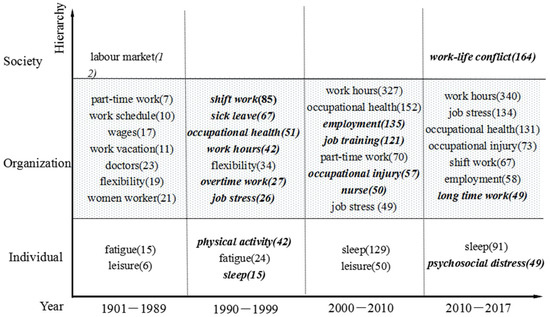

Ijerph May 2018 Browse Articles

How To Calculate Payroll Taxes Wrapbook

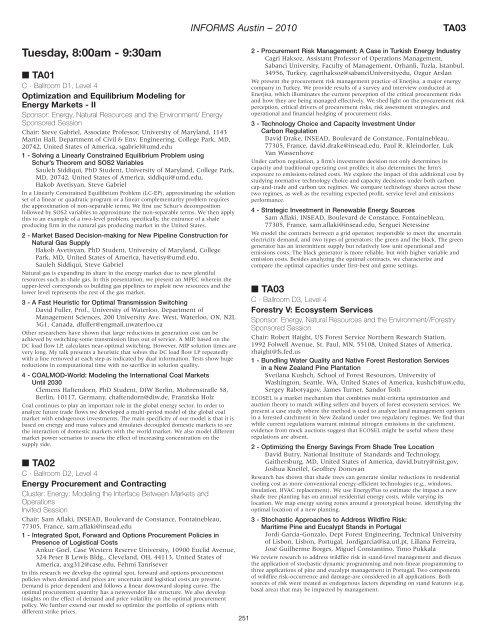

Tuesday

Avusturya Izin Yolu Gurbetciler

Pdf Welfare Reform Stacy Deck Academia Edu

What Is 80 Percent Of My Salary And How Much Do I Take Home After Tax Uk Tax Calculators

Kentucky Paycheck Calculator Tax Year 2023

Us Vs Uk Doctors Salary Detailed Comparison Revising Rubies

2009 Front End Conceptual Estimating Yearbook Pdf Euro Engineering

Ectmih2021 Supplement 2021 Tropical Medicine International Health Wiley Online Library